Understanding Car Insurance Costs

In case you’re wondering about the national average cost of car insurance, it’s $136 a month. As you’re going to be paying for insurance for as long as you drive, you’d probably want to get an affordable policy. However, various factors including your driving history and location determine how much you’ll have to pay. Let’s take a closer look at some of these factors:

- Annual mileage: The more you drive, the more you’re at risk of an accident. A high mileage usually means you have to pay more for your insurance.

- Theft rates: Staying in an area where vandalism and vehicle theft rates are high will lead to higher insurance costs.

- Driving history: You’ll have to pay higher premiums if you have a record of high accident rates

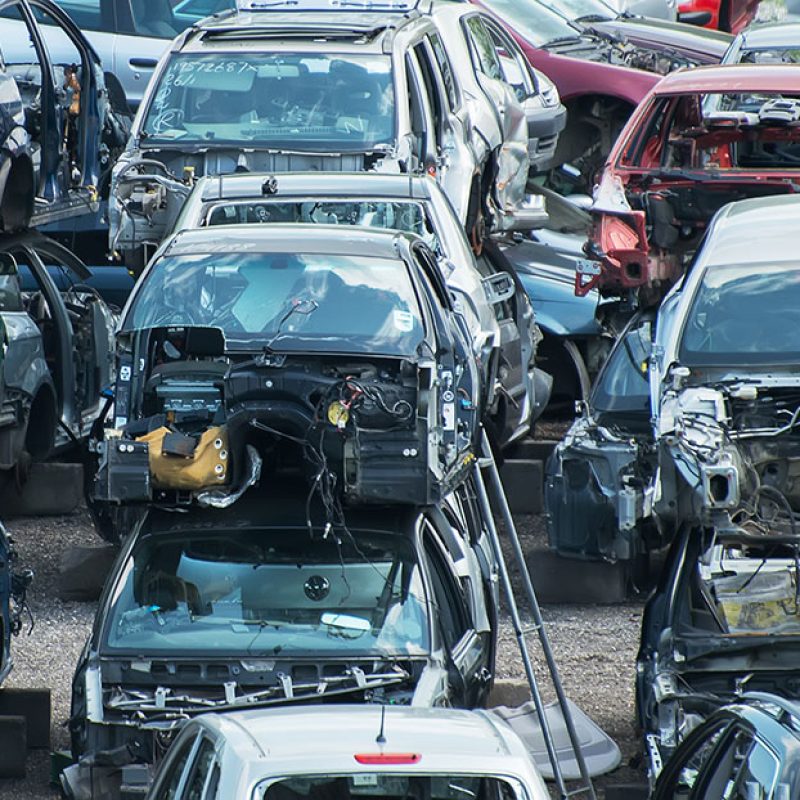

- Vehicle repair costs: Usually, insurance premiums for domestic cars are cheaper compared to foreign cars because the latter may contain parts that are costly to replace.

- Claims record: A higher number of claims filed in the past will raise your insurance cost

- Safety features of your vehicle: Certain safety features may entitle you to discounts but this doesn’t mean your insurance is cheaper, especially if these features are costly to replace or repair.

- How you use your vehicle: If you use your car excessively during peak hours, such as for work or school, the cost of your insurance premiums will be higher.