K&N Insurance Brokerage • Copyright © 2024. All Rights Reserved.

All Rights Reserved.

Comparing insurance quotes and rates helps you get the most value for your money. An insurance quote is an estimate that details how much you can expect to pay for insurance policies over a period of time. This document is typically provided by the insurance company itself and the rates are affected by the coverages you choose. Before you can request an insurance quote, the firm may require some personal and vehicle information, e.g., Social Security number, address, car’s mileage, and/or Vehicle Identification Number (VIN).

Why is Comparing Quotes Important when Shopping for Car Insurance?

Today’s insurance companies utilize various underwriting methods. This means that the insurance rates you are quoted by one company might not match the quote of other competing companies. In addition, insurance rates can change based on the trends in the wider insurance market. Due to the

many variables at play, it is recommended that you compare insurance rates from several companies, which is something that K&N Brokerage can help with. Shopping around for cheaper rates is especially important for people who lack a clean driving record or have a poor credit history.

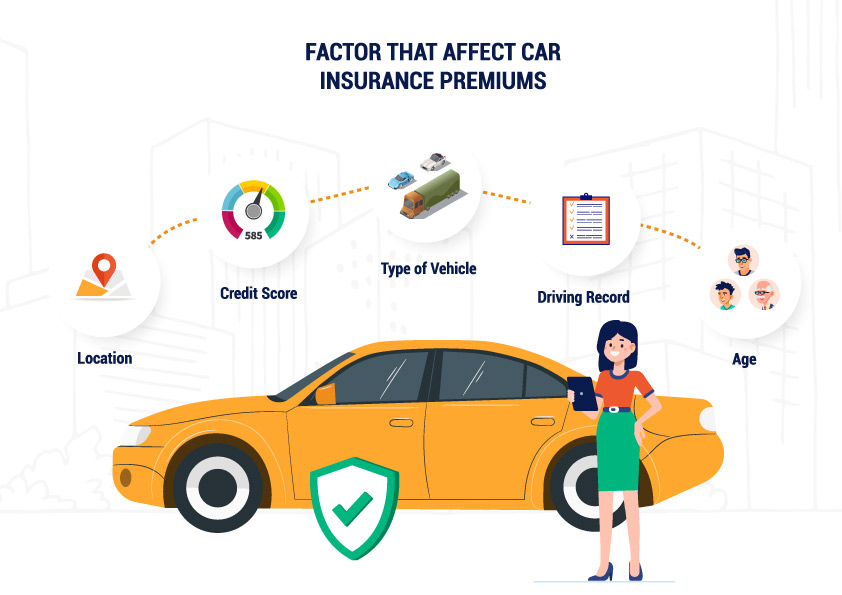

Factors that Affect Car Insurance Premiums

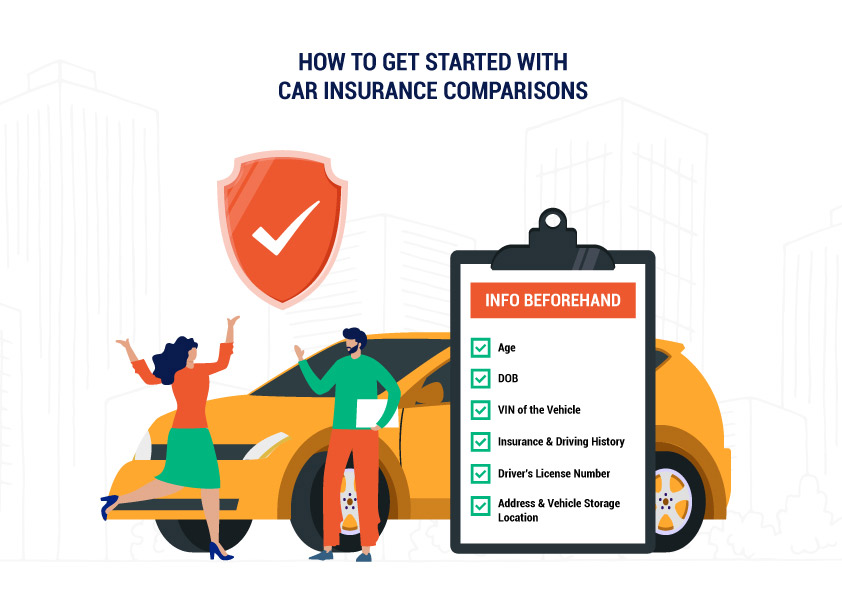

How to Get Started with Car Insurance Comparisons

If you want to get insurance quotes as easily and quickly as possible, prepare the following information beforehand:

Always exercise due diligence when assessing an insurance company. At the end of the day, you want an insurer that protects you if an accident occurs, your property is damaged, or your vehicle gets totaled. According to the Insurance Information Institute (III), you should compare at least three

quotes from different insurance providers. Each quote you request should be based on the same set of deductibles, liability limits, and coverages.

If you need any help understanding your insurance quotes, it is important to consult with an experienced and knowledgeable insurance broker. At K&N Brokerage, we can help you customize an insurance policy and select main and optional coverages that suit your long-term needs.

K&N Insurance Brokerage • Copyright © 2024. All Rights Reserved.

All Rights Reserved.